The Introduction of the Euro – A Catalyst for EU Economic Decline?

The Effects of the Euro: An Analysis from a Modern Monetary Theory (MMT) Perspective.

“…whenever I am studying European data I think how stupid the European Monetary Union (EMU) is from a modern monetary theory (MMT) perspective.“ MMT Economist Bill Mitchell

In May 1999, Christian Noyer, Vice-President of the European Central Bank, said at a conference organised by the Swedbank: “The first months of the euro have been successful in both political and operational terms.” Well Christian, it may have started well, but as I point out in this article, the Eurozone boat has been ‘heading for the rocks’ ever since.

Building on my recent monetary sovereignty piece, in this short article I concentrate on the Euro and its impact on the countries that use it. Specifically, I examine how the loss of national monetary sovereignty has increased the risk of economic crises for many Eurozone states. My conclusion—one familiar to MMT advocates—is that the Euro, in its current form, is going to need fundamental reform if it is to survive.

The Introduction of the Euro in 1999

The Euro was introduced as a digital currency on 1 January 1999, followed by physical banknotes and coins on 1 January 2002. This change effectively stripped member states of their ability to issue their own currency—and, of course, to make their own policy choices in many important areas, including the ability to control their own exchange rates.

"I think that the central government of any sovereign state ought to be striving all the time to determine the optimum level of public provision, the correct overall burden of taxation, the correct allocation of total expenditures between competing requirements and the just distribution of the tax burden.” ‘Maastricht and All That’ by Wynne Godley in the London Review of Books 1992

As I discussed in my previous article, currency issuance is a requisite for full monetary sovereignty.

“Full monetary sovereignty implies that a government issues its own currency, collects taxes in that currency and has the power to spend and design policies without interference from outside forces.” Your Bare-Bones Guide to Monetary Sovereignty

Countries like France, Germany, Italy, Spain, and Greece are users of the Euro, which is controlled by the European Central Bank (ECB). This effectively means these Eurozone countries—in terms of their currency sovereignty—have downgraded themselves to the power of households. That is, instead of being issuers of their own currency, they now have to generate income before they can spend. To generate that income, they need to tax or they need to borrow. This makes them vulnerable to the ‘austerity impulses’ of the ECB: which is effectively, a built-in mechanism that makes any financial crisis progressively worse.

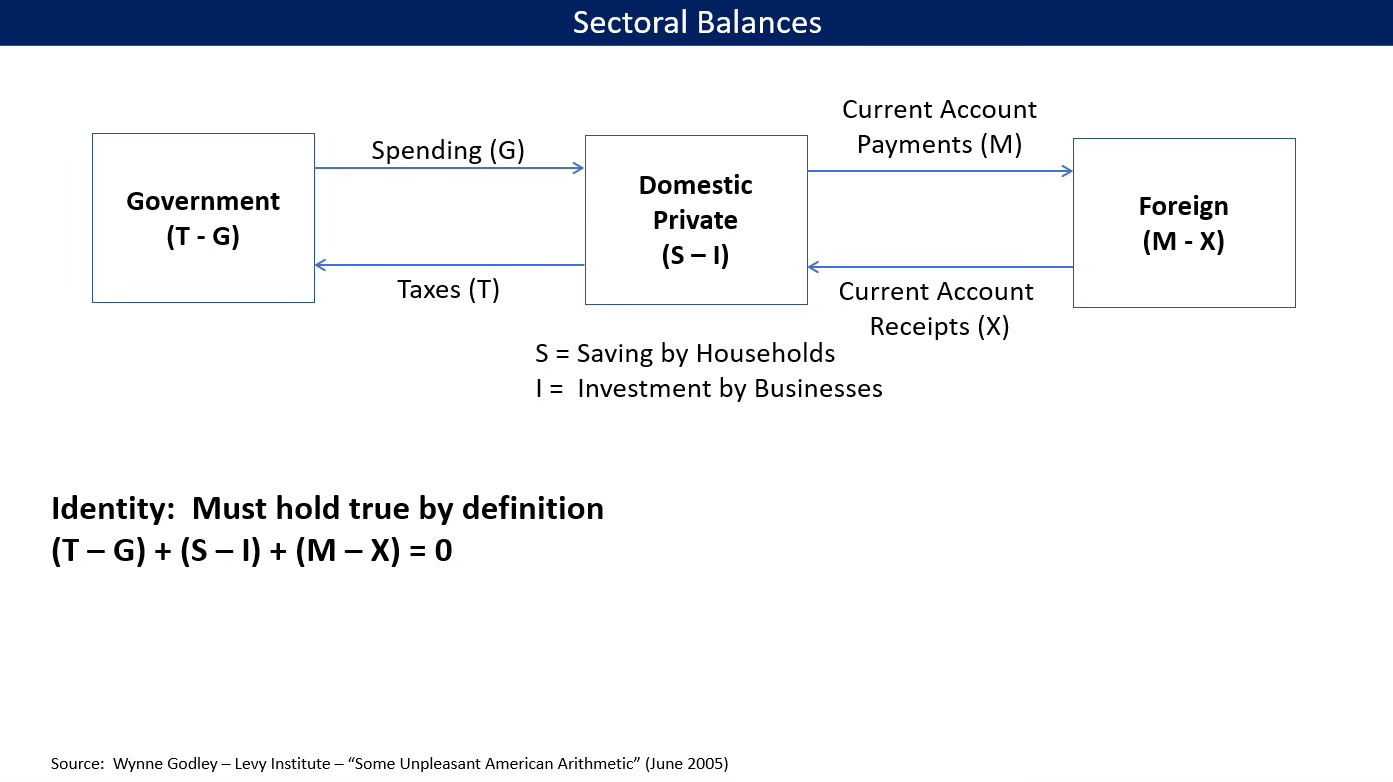

A Sectoral Balances Approach Reveals the Folly of Austerity Policies

A sectoral balance approach (see my definition of the sectoral balance approach in Jargon Buster part 4 and my Wynne Godley article) tells us that when the private sector is in deficit (i.e. less income coming in from taxes and other sources and than spending going out), either the government sector or the foreign sector must be in surplus. Because, every financial transaction has two sides; logically that means, that a deficit in one sector implies that another sector must be in surplus. So, if the private sector is spending more than it earns, it can only do so if either the government is injecting money through deficit spending or if the country is running a trade surplus, i.e. bringing in more money from exports than it spends on imports. In short, if one sector tightens its belt, another must take on more spending or the economy shrinks.

If both the government and the private sector are cutting spending that only leaves the foreign sector to make up the shortfall: and it’s logically impossible for all countries to run a foreign sector surplus. Sectoral balance logic tells us that ‘this is so’, as does ‘common-garden’ logic. I cover this ‘sectoral balances’ idea in more detail later in this article

Eurozone Countries Can’t Devalue Their Currency to Become More Competitive

MTT advocates are aware that countries often fix or devalue their currencies in their attempts to remain competitive: the idea is that cheaper exports will make them more attractive to foreign buyers (though of course it also means dearer imports and potentially importing inflation). That’s not to say that MMT advocates regard this as a good strategy beyond the short term. However, whether it’s good or bad, the fact is that Eurozone countries no longer have that option: i.e. they cannot adjust their currency value as they have no control over the value of the Euro.

“ If a country or region has no power to devalue, and if it is not the beneficiary of a system of fiscal equalisation, then there is nothing to stop it suffering a process of cumulative and terminal decline leading, in the end, to immigration as the only alternative to poverty and starvation.” Maastricht and All That – Wynne Godley

Instead, as Euro countries find themselves to be uncompetitive, both the government and the private sector start to cut costs. As tax income goes down—and with no ability to issue their own currency—governments raise taxes and cut spending to balance their budgets; i.e. in their attempts to meet the rules of the ECB’s ‘Stability and Growth Pact’, which limits government deficits to 3% of GDP.

“National fiscal policy was ruled by arbitrary deficit limits, 3% of GDP and unenforceable public limits of 60% of GDP. So, there’s really nothing scientific that backs up those numbers. I think the 3% was invented by a clerk or lowly bureaucrat in the ministry of finance in France because it was roughly a number that was not harmful…(to France).” Economists Dirk Ehnts

At the same time, businesses respond to the downturn by reducing their costs, including wages, to stay competitive. However, this combined with lower government spending, means a reduction in overall demand in the economy – which leads to higher unemployment. So, as household incomes go down and domestic demand falls, inevitably the economy shrinks. And as the economy shrinks the government brings in less tax income which increases the deficit. It’s a downward spiral. Just at the time when the economy needs an injection to increase aggregate demand the government is making cuts to fit in with arbitrary ECB rules.

ECB Deficit Rules Make Deficits Larger, Not Smaller

The ECB’s deficit rules, which are designed to reduce deficits, in practice push deficits up, as governments bring in less tax income (lower income plus greater spending equals higher deficits). This reveals austerity measures for what they are: illogical, ineffective and dangerous the health and wellbeing of citizens.

Greece's GDP contracted by approximately 26% between 2008 and 2013.

The unemployment rate escalated from 7.8% in 2008 to a peak of 27.5% in 2013, with youth unemployment reaching as high as 64.9% in May 2013.

By 2014, 36% of the population was at risk of poverty or social exclusion, a significant rise from previous years.

Over 400,000 individuals, approximately 9% of the labour force, emigrated during the crisis years, seeking better opportunities abroad.

“A new study by dozens of researchers from the University of Washington and around the world has found that Greece’s population health declined markedly and death rates rose sharply after harsh austerity measures were imposed on Greece by the European Union and the International Money Fund in 2010.” Researchers at UW bolster study of how austerity devastated Greece’s health

“Consistent harmful impacts of austerity were demonstrated for all-cause mortality, life expectancy, and cause-specific mortality across studies and different austerity measures. Excess mortality was higher in countries with greater exposure to austerity.” Is Austerity Responsible for the Stalled Mortality Trends Across Many High-Income Countries? A Systematic Review

I could not find figures for deaths related to austerity for Eurozone countries but we can get a sense of how severe they may have been by looking at deaths due to austerity in the UK.

A study, ”Over 300,000 ‘excess’ deaths in Great Britain attributed to UK Government austerity policies”, led by the Glasgow Centre for Population Health and the University of Glasgow reported an additional 335,000 deaths across Scotland, England, and Wales between 2012 and 2019, compared to expected trends.

If you’re finding value in these articles, become a paid subscriber. Your support allows me to continue to write, teach and to build a community of like-minded individuals—individuals, like you, who understand that MMT offers an opportunity to change the world for the better. Become a paid subscriber now.

But Why Can’t Eurozone Countries Just Borrow to Make Up the Shortfall?

As MMT advocates know, selling bonds (i.e., ‘borrowing’) for currency issuing countries is not used to raise revenue: it just swaps reserves for interest bearing bonds. However, for countries that do not issue their own currency, such as those in the Eurozone, selling bonds can be used to raise revenue. The problem is that in times of economic weakness, investors will push for higher returns on their investments, to mitigate the (realistic) risk of default. Paying those higher interest rates drives up government debt (note that the ECB also has an arbitrary rule for debt levels: government debt must not exceed 60% of GDP), which for countries that do no issue their own currency is a real problem: because Eurozone countries are like households, they are not currency issuing governments. So, that debt has to be serviced - and that, requires income: the very thing they are getting less of. This situation was exacerbated by a ECB’s reluctant to purchase the government bonds of Eurozone countries.

As a countries debt levels are pushed higher – the ECB–consumed by its orthodox views on how to fix the economy - imposes stricter austerity rules. As Greece found to its cost–there is no way out of a crisis when control of your currency and your fiscal (effectively due to deficit limits) & monetary policies have been taken away from you. A country that cannot balance reduced government spending by increasing export earnings (they cannot devalue their currency) will suffer massive unemployment, serious wellbeing and health issues for citizens and inevitable economic decline.

The Imposition of Austerity Policies Undermines Democracy

As a side note on Greece; on July 5, 2015, the citizens of Greece voted against continued austerity polices (61% of voters rejecting the bailout conditions that included deep cuts to public spending and tax increases). It was not just economic control that was taken away from Greece - democracy was also annulled.

Problems with Adopting the Euro Were Not Confined to Greece

Between 2008 and 2013, public investment in the Europe’s least developed countries fell by 45% . As a result Governments failed to invest in their infrastructure and unemployment in many EU countries reached records levels: Eurozone unemployment reached record levels in March 2013 at 12.1%, up from 11.6% in September 2012 and 10.3% in 2011 (Eurostat). This trend was particularly pronounced in countries like Spain and Greece, where austerity measures and economic downturns led to the highest job losses.

Member states have been unable to invest due to the restrictive practices of the ECB, i.e. the strict deficit constraints imposed as a result of the EU’s ‘Stability and Growth Pact’, or as MMT advocates call it. ‘Stability and Growth Preventing Pact”. The ‘Stability and Growth Preventing Pact’ imposed an arbitrary 3% cap on budget deficits relative to GDP and an arbitrary 60% cap on public debt. MMT advocates point out that these limits that have no economic justification, only serve to make economic downturns worse: just when they need a fiscal stimulus they were told to make cuts: stifling growth and exacerbating unemployment.

Examining the Eurozone Countries from a Sectoral Balances Point of View

Legitimately you may ask, if the Eurozone was such a bad idea why did some countries do well out of the arrangement? The adoption of the Euro initially helped Germany, Luxembourg, and the Netherlands. They did relatively well. Primarily this has been due to their inherent economic strengths:

Germany: strong industrial base and high value exports (machinery, automobiles, and chemicals).

Luxembourg: major hub for banking and investment funds.

Netherlands: export-driven economy (machinery, chemicals, oil, high-tech equipment).

Adopting the Euro for these countries eliminated exchange rate fluctuations and currency conversion fees. Lower interest rates allowed cheaper financing, which encouraged expansion. For these countries a single, fixed rate currency gave them access to a large market.

Germany, for example, has maintained a substantial trade surplus, exporting more than it imports. From a sectoral balance perspective: a surplus for Germany, in relation to other Eurozone countries, logically must mean corresponding deficits for those other Eurozone countries, i.e. countries that import more than they export.

Given the disparities between countries, the economic imbalances within the Eurozone are inevitable. Surplus countries will see their economies grow while deficit countries will see their economises shrink. And as they shrink they will get the double punch of austerity policies forced upon them - to ensure they shrink even faster.

Until recently Germany has largely avoided the economic struggles faced by other Eurozone nations due to its strong export sector. Unlike nations with persistent trade deficits, which are forced into austerity under Eurozone fiscal rules, Germany’s ability to balance its sectoral accounts has provided greater financial stability, insulating it from the debt crises that have plagued countries like Greece, Spain, and Italy.

If you’re finding value in these articles, become a paid subscriber. Your support allows me to continue to write, teach and to build a community of like-minded individuals—individuals, like you, who understand that MMT offers an opportunity to change the world for the better. Become a paid subscriber now.

Is There a Solution for These Eurozone Issues?

One way to mitigate the Euro’s structural problems would be to make the EU a political union similar to the US, with centralised tax and spending policy. This solution is, of course, unlikely and, for the countries involved, unpalatable. The other solution is to allow countries to regain their monetary sovereignty by reintroducing their own currencies

“What I find totally baffling is the position of those who are aiming for economic and monetary union without the creation of new political institutions (apart fro a new central bank), and who raise their hands in horror at the words 'federal' or ‘federalism’." ‘Maastricht and All That’ by Wynne Godley in the London Review of Books 1992

Without these changes, the EU’s economic imbalances are inevitable, and the ECB’s unnecessary austerity policies will continue to mean financial crises for the weaker member states. The Euro may well have worked for some Eurozone countries but it has been a disaster for others. This is a situation that can’t last.

That’s all for now. Don’t forget to subscribe to support MMT101DOTORG. Spread the word that a better world is possible.

Support MMT101.org by Becoming a Paid Subscriber

If you are enjoying these articles and find them a useful part of your Modern Monetary Theory (MMT) education, please support MMT101.ORG—if you can—via small donation. $5 (or the equivalent in your own currency—SubStack uses US dollars) will allow me to continue this work and reach & teach more people. If you can’t do that, consider sharing the articles and podcasts. By subscribing and supporting, not only will you learn how the economy works, but you will also be part of the efforts to change people’s lives for the better. I do not have the power to do that alone, but as an ever-expanding group who understand that there is a better way, we can make a difference.

Thanks,

Jim

Good solid piece. Whether is the US, UK or even Europe its truly unfortunate that austerity is being embraced so much. We need to wake up and realize how devastating that word can be and the nations who are use the Euro can read this piece too as to how important it is to have your own currency and not be forced to accept balanced budgets and/or budget surpluses. Thanks for spreading the word out on this.

What is with all these austerity ideologues? Have the programs of near starvation of govt programs ever worked any where? Mention the word 'spend' and it strikes fear into everyone. Just like the imposition of deep cuts to fund govt service agencies in the US and huge worker layoffs are more likely to harm than lead to any so-called efficiency. Quite the opposite. This austerity, indeed, is undermining Democracy. It seems like it is doing the same thing in EU with its rise in extreme right wing political parties competing for control.

I will have to reread your essay to fully grasp exactly how the Eurozone econ system works because I was a little confused on the use of some of the terms and what they were referring to. As usual, I will go to other sources to try to better understand.