Killing the Myth of Government Borrowing Stone Dead: Gilts, T-Bills, Interest Rates and the Truth About Money Printing

A plain-language guide (with all the jargon explained) to what government bond sales really do — and why it’s not about raising money. A Modern Monetary Theory (MMT) perspective.

What you will learn:

An understanding of what government borrowing really means in a monetary sovereign country; why the government doesn’t need to borrow its own currency; why selling gilts and T-bills is not about raising money but managing interest rates; why bond sales are better understood as asset swaps; and how the truth about government borrowing exposes one of the biggest myths in mainstream economics.

Technical Terms/Jargon Used in This Article

You will find definitions of all of the technical terms/jargon used in this article in my series of MMT Economic Jargon Buster articles. Paid subscribers can also download my MMT Dictionary.

The truth about government bond sales and the myth of government ‘borrowing’

“The only thing the government will accept in payment for the bonds that it issues is its own debt, its own IOUs. So bonds sales don’t change the amount of debt out there, the Change the form from non-interest paying to interest paying” Professor Randall L Wray

Hang on to your hat, this newsletter goes a bit deeper into the details of how government bonds sales work than would normally be considered decent. When it comes to the selling of government bonds my simplified tale has always been something along the lines of the following: “the government does not sell bonds to raise money but instead it sells them to control the interest rate and to provide buyers with a safe interest bearing investment. No money is raised in this process, it merely swaps bank reserves for interest bearing government bonds.”

Though simple and succinct, that description of government borrowing remains true. However, I often get pushback from orthodox economists and others who insist I am wrong. I’m wrong, because ‘all government spending money is derived from taxes and government borrowing - and that borrowing is enacted via bond sales’. I can understand why they think that - it is the orthodox story and it fits with how bonds work within the private sector.

So, to undermine that orthodox story we need to delve a little deeper into the details of government ‘borrowing’; we need to uncover – and demystify – the actual processes involved: so that the next time someone questions my story, I can point them to this newsletter.

Having said that, government finance and the framework of institutions surround it are complex and multilayered. So, I will be doing my best to make this story as clear as I can (if I fail, please put your question in the discussion area - and if you disagree with anything I’ve written please post in the discussion area below) and the way I intend to do that is simple: by providing definitions of the institutions, mechanisms and tools involved - discussing them in turn - to uncover their roles and the actions they take in the process of ‘government borrowing’.

I will introduce you to the jargon, the relevant institutions, the reasons for government bond sales – and the jigsaw of components involved in the process. As I define each in turn, a picture will emerge from that will tell its own story: and that is a story that kills the myths of government borrowing stone dead. Ok, let’s start with the very basics - defining the phrase ‘government bond’.

If you have any feedback or questions or if you disagree with anything I write in this article, I want to hear from you. I value your input whether you agree with me or not. Please add your comments in the discussion area.

What Is A Government Bond?

In the UK the word bond is either used as a generic, umbrella term for all government securities (securities is just a catch-all name for the different kinds of investment products), or it is synonym for UK Government gilts (for ‘gilt-edged security’). When UK economist talks about government bonds they are mostly referring to government gilts. A government gilt is an investments tool provided by the UK Government: the safest of all investment tools because it is government backed.

But before we get to the government stuff, let’s start by outlining how bonds are used in the private sector.

Private sector bond sales

In the private sector companies issues bonds to raise money to invest in their businesses and to provide an interest earning investment for those who purchase their bonds. Bonds are issued for set periods of time, for example, 3 years or 10 years. Throughout that period investors get an interest payment. When that period ends (i.e. when the bond ’matures’) the investor gets their original investment returned, in addition to the interest they have been receiving. In this scenario companies are using bonds to borrow money from investors in order to grow their businesses.

Government bonds are something different

That’s how bonds work in the private sector. However, UK Government bonds are an entirely different ‘kettle of fish’: they are not used to raise funds and are not used to provide the government with spending money. They are, as I said in my introduction, used to manage interest rates.

Financial instruments: types of government securities

There are two main types of government security (the word security is just an umbrella term for the range of interest-bearing investments offered by the government). There are UK Government Gilts and there are Treasury Bills (T-bills). The main difference between them is their lifespan, i.e., how long before they ‘mature’ (i.e., that means, how long before you get your original investment back) and the roles they play in managing interest rates.

What are gilts?

Gilts are an interest-bearing financial asset issued by the UK government. In practice they are issued by the UK Debt Management Office (DMO) (I will define this shortly) on behalf of HM Treasury. As they are literally the safest form of investment in the UK, and as such, they are mostly purchased by pension funds.

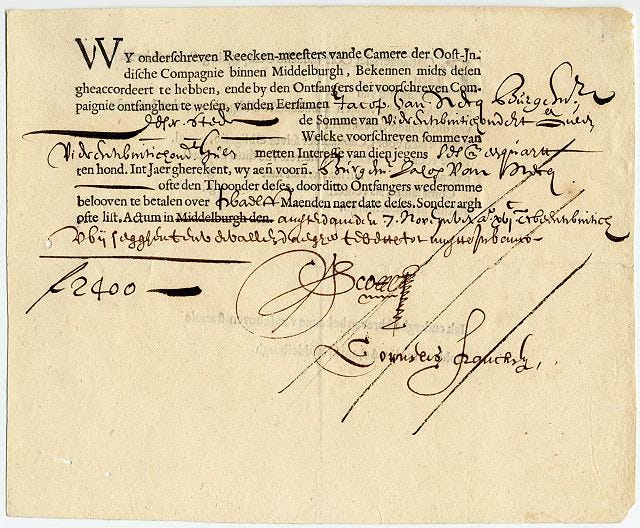

For the uninitiated, the best way to understand what a Gilt is, is to think of it as being similar to paper money, as was the case in the past, except that the holder of the gilt receives interest, while the holder of paper money doesn’t. Ultimately gilts are just another form of money - a form of money with particular characteristics: they pay interest and the money you used to buy them is returned to you after a specified period of time. Gilts are long-term government securities, typically ranging from one year to 50 years, although some have maturities of up to 100 years or are perpetual.

What are Treasury Bills (T-Bills)

Treasury Bills are short-term securities (from 1 day up to 364 days) issued by HM Treasury, via The UK Debt Management Office (DMO) (I define the DMO below). Treasury Bills have a maturity of one year or less. T-Bill do not carry an interest rate but instead are sold ‘at a discount’ to their face value. For example, if you buy a T-Bill with a ‘face value’ of £1 and you bought it at 90p – you are getting it ‘at a discount’ of 10%. Simple.

T-bills are issued in what is called, the ‘primary market’ (the primary market is when government securities are sold directly by HM Treasury/Debt Management Office) through regular ‘auctions’ (i.e. banks and chosen financial institutions can bid to buy them).

“The Bank of England would manage the cash requirements of the government and geared them toward managing the Monetary Policy Committee’s decisions on the level of short-term interest rates. If the government’s short term cash transactions didn’t create a daily shortage in the money markets (in order for the CB to enact monetary policy), then the Bank created a shortage by draining reserves through the sale of Treasury Bills.” Gower Institute For Modern Money Studies (GIMMS)

So, GIMMS tells us that T-bills are used to drain reserves.

“Treasury bills can be used as collateral in the Bank of England’s Open Market Operations and in Real Time Gross Settlement (RTGS) and are included in the main traded class of gilt Delivery by Value (DBV) for repo transactions.” Debt Management Office

Real Time Gross Settlement (RTGS) is the payment system banks use to settle transactions with each other in real time: it specifically refers to transactions that are settled individually and immediately, not grouped together or at a later time. Treasury Bills can be used as collateral when banks settle those payments.

The phrase Open Market Operations is just the official term for when the central bank buys and sells securities to influence interest rates.

If you’re finding value in these articles, become a paid subscriber. This is a 100% reader-supported newsletter. Your support allows me to continue to write, teach and to build a community of like-minded individuals—individuals, like you, who understand that MMT offers an opportunity to change the world for the better. Become a paid subscriber now.

The overnight interest rate is the rate at which commercial banks charge for interbank loans

Banks with reserve accounts give each other loans to tide them over when their reserves are low. Here is how it works.

When a customers pays for a service or goods and makes the transaction via their bank. If the business who sold them that service or good uses a different bank, there needs to be a way to settle the accounts between those banks. Central bank reserve accounts provide that service. I.e., banks settle accounts with each other via their central bank reserve accounts.

Sometimes the level of a banks reserves gets low: in those circumstance in order to settle their accounts they first need to top up their reserves by getting a loan: and the first port of call, is another bank (if they can’t get a loan from another bank the central bank will provide the loan facility- but at a higher interest rate). If banks have lots of reserves swishing around in their central bank reserve accounts; then the interest rate they can charge will be low: because banks are competing with each other to provides those loans. If reserves are scarce, the are able charge a higher interest rate.

Because banks have traditionally settled accounts with each other overnight, the interbank interest rate is called the overnight interest rate or the ‘bank rate’.

It is the interest rate on these interbank loans that the central bank is manipulating with their securities sales. The central bank uses gilt and T-bills to manipulate the amount of reserves in the system and this in turn manipulate the overnight interest rate.

So, we can see from this scenario that government securities are sold to banks in order to makes reserves more scarce, and because this drives up the overnight interest rate.

In short, the UK's Monetary Policy Committee (MPC) sets the target for the bank rate. The central bank then manipulates the amount of reserves in the system to hit that target rate.

Comparing the role of gilts and T-bills

Both gilts and T-bills are both used to influence interest rates, in different ways. T-bills are used for short-term adjustments. For example, to alter the overnight interest rate between banks, while gilts are more about managing longer-term interest rates, overall market conditions, and for providing a safe investment for pension funds, insurance companies and other investors who want a guaranteed return. T-bills are focused on the short-term, and gilts are used for longer-term market influence.

Ok, let’s move on.

More Jargon, More Institutions

In this section I uncover some related jargon and the names of institutions involved in the government transactions and explain their roles in the process. Those institutions include, for example, UK's Monetary Policy Committee (MPC), The Ways & Means account and this interesting piece of jargon, ‘Overt Monetary Financing (OMF) ‘ all of which add some context to help us understand the ‘borrowing’ process.

The role of the UK's Monetary Policy Committee (MPC)

The Monetary Policy Committee (MPC) is at the top of the trees as far as our story goes - because it is the MPC that sets the target interest rate. The MPC a nine-member group within the Bank of England that meets eight times a year to set and announce monetary policy. Their main job is to keep inflation around 2%, while also supporting the government’s wider economic goals. So, it is The Monetary Policy Committee (MPC) that sets the official Bank Rate (another name for the overnight interest rate), i.e., the interest rate the Bank of England uses as its target for overnight lending between banks.

The UK Debt Management Office (DMO)

The UK Debt Management Office (DMO) is the government body that manages the sale of government bonds (gilts) and Treasury Bills (T-bills) on behalf of HM Treasury. The DMO runs regular auctions of gilts and T-bills and helps smooth out the timing of government payments and receipts.

The Ways & Means Account provides short term liquidity

The Ways and Means account is basically the government's overdraft at the Bank of England. It lets the government make payments even if bond sales haven’t happened yet or don’t happen at all. The Ways & Means account helps smooth things out so there’s no panic or disruption when money needs to spent into existence.

For example, during the COVID pandemic, the UK government made use of the Ways and Means account to ensure it could keep making payments, especially to businesses and furloughed workers, without needing to wait for bond sales. It was a way to quickly get cash out quickly.

“HM Treasury and Bank of England announce temporary extension to Ways and Means facility – HM Treasury and the Bank of England (the Bank) have agreed to extend temporarily the use of the government’s long-established Ways and Means (W&M) facility.

As a temporary measure, this will provide a short-term source of additional liquidity to the government if needed to smooth its cashflows and support the orderly functioning of markets, through the period of disruption from Covid-19.” Bank of England Press release 09 April 2020

Uncovering the role of the Ways & Means Account

On the UK Governments own website, we find the following definition of the Ways & Means Account,

“As a temporary measure, this (i.e., the Ways & Means Account) will provide a short-term source of additional liquidity to the government if needed to smooth its cashflows and support the orderly functioning of markets, through the period of disruption from Covid-19”

Chairman of the Ways & Means, the Right Hon Lyndsay Hoyle MP described it in talk, in the following way.

”Provision of revenue to meet national expenditure. The ways and means to keep the country going or to finance a new policy Chairman of the ways and means … the handing out of the money raised through taxes.”

On the MMT focused Gower Initiative for Modern Monetary Studies (GIMMS) website we find the following statement.

“Managing the government’s spending when the government issued debt-free Sterling, was done by a process now referred to as Overt Monetary Financing. This used what was, and still is, known as the government’s Ways & Means account at the Bank of England. Gilts were issued by the Bank, as a way of setting the desired interest rate. The Ways & Means account was a balancing account.”

The phrase ‘debt-free Sterling’ in this context refers to money the government spends without issuing bonds (like gilts or T-bills), i.e. were was no pretence of ‘borrowing’ involved in the transaction.

Overt Monetary Financing (OMF): the mechanism for issuing debt-free Sterling

“OMF brings together the central bank and the treasury functions of government into a coherent framework whereby the central bank merely credits private bank accounts on behalf of the government to indicate the spending initiatives implemented by the Treasury.” Bill Mitchell - Overt Monetary Financing – Again

Overt Monetary Financing (OMF) is the mechanism by which the debt-free Sterling - mentioned above - is achieved. Via this mechanism, the central bank directly finances government spending without the need for government borrowing, i.e., spending not accompanied by the issuance of government debt (like gilts or T-bills).

This is money created and spent directly by the government without ‘borrowing it first’. Here is how the GIMMS website describes Overt Monetary Financing (OMF).

“Overt Monetary Financing (OMF) is a means for the Treasury to instruct the central bank to spend a particular amount and the central bank makes sure that that money is always available in the government’s account…The government would draw on those funds to directly transfer money into the bank account of whoever they need to pay (this could be a firm or private citizen). The payments could be made either by electronically crediting the account or via a cheque, which the payee deposits in their bank.” The Gower Initiative for Modern Money Studies (GIMMS)

And here is how MMT economist Bill Mitchell describes it.

“Overt Monetary Financing (OMF), which simply means that all of the unnecessary hoopla of governments matching their deficit spending with bond-issuance to the private bond markets, as if the latter are funding the former, is dispensed with.” Bill Mitchell

Note, that paid subscribers resources are now on this page. Downloadable factsheets, a downloadable dictionary of economic jargon, my book/journal recommendations and more.

The Government Is Printing Money - And I Feel Fine

Overt Monetary Financing (OMF) as a vehicle for debt-free Sterling, makes it 100% clear that currency issuing governments do not need to borrow before spending. The UK Government issues currency without ‘borrowing’ via the OMF.

I may be fine about that - because of course all government currency is in effect new money - but orthodox economists tend to be not so fine with the idea of this mechanism being quite so overtly stated. Because this is what they call, ‘money printing’. And money printing strikes fear into the hearts of all sensible, clean-living, balanced budget orthodox economists and all self-righteous followers of fiscal rules.

Money printing, they tell us, will inevitably lead to runaway inflation. Because just as when you use a pump to blow up the tyres of your car, you always keep the nozzle attached until the tyre explodes - and likewise, you will continue to print money even after it’s clear it is causing prices to rise.

Is that true for you - do your tyres explode every time you pump the up? Or, maybe you just stop when your tyre reaches the recommended pounds per square inch (PSI)?

The fact is, every UK pound spent is analogues to printing money. New money does not exist before it is authorised by parliament and spent into the economy by the actions of the central bank.

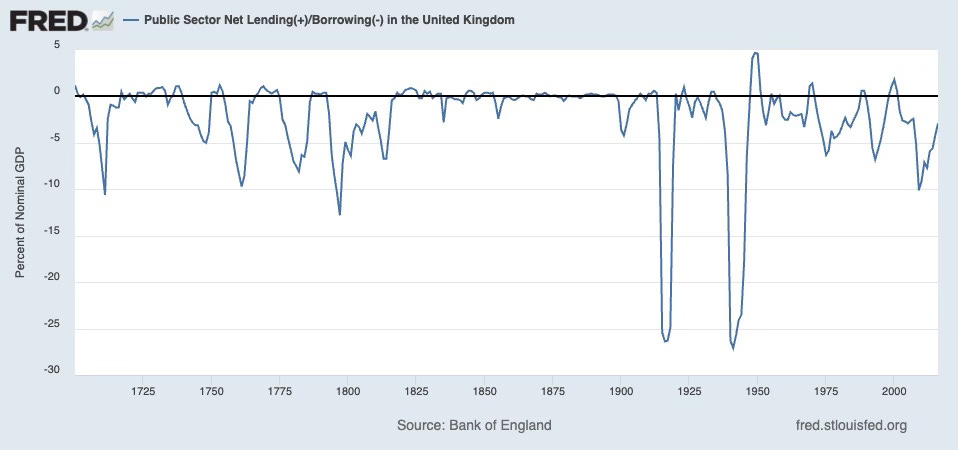

The UK government has been overspending (i.e., running deficits) for most of the last 300 years.

Actions that increase reserves and actions that reduce reserves

I suspect (because government spending happens daily where as tax collection is intermittent) that the governments daily financial transactions, more often than not, will create a glut of reserves in the system. This will drive down overnight interest rates. Therefore, it is the Bank of England’s job to ensure a shortage of reserves - in order to allow it control over interest rates - which it does by selling Treasury Bills.

This helps the Bank control the overnight rate, which is key for managing the wider economy.

In Summary: Government Borrowing Does Not Earn Spending Money For the UK Government: Its Role Is To Control Interest Rates

There are actions that increase reserves. For example, government spending, the government buying back securities and Central Bank lending to commercial banks. And there are actions that reduce reserves, for example, citizens and businesses paying their taxes and government selling gilts and T-bills.

The Bank of England has been given the job to manage the government's money, and part of that job is to ensure the bank rate is kept at the rate stipulated by the Monetary Policy Committee (MPC). It does this by the buying and selling of government securities. No spending money is borrowed during this process.

Ok, that’s all for now.

If you have any feedback or questions or if you disagree with anything I write in this article, I want to hear from you. I value your input whether you agree with me or not. Please add your comments in the discussion area.

Don’t forget to subscribe. If you are finding these newsletters useful and want to support me to continue to write and teach MMT, please become a paid subscriber. It helps me to continue my quest to help as many people as possible to understand how our monetary system works.

Links to some of my most popular newsletters

Become a paid subscribers for access to additional content:

A Permanent Home for MMT101 Paid Subscriber Resources – Factsheets, book recommendations, academic papers, MMT podcasts and more.

MMT Factsheet 3: If Taxes Are Not For Spending What Are They For?

Hi Jim - you mention that T-Bills are “traded” on a secondary market but I don’t think that’s strictly the case, ie as it is with gilts. There are “Primary participant” banks who buy them from the DMO and they will sell them on to holders but I don’t think they are traded. Similarly, are you sure the BoE sells T-Bills to commercial banks, do they not get them as Primary participants, directly from the DMO? I’m confused.

With regard to the ways & means account, I understood that was the primary overdraft facility with the BoE but, as you say, it’s pretty much only been used as such in the past 20 years in times of emergency, eg the crash & Covid. Today wouldn’t the daily equivalent be the Consolidated Fund facility which is akin to an overdraft and records all gov’t spending, tax receipts, bond sales and redemptions?

Cheers

I'm not an economist, So there is stuff I might misunderstand. but with that said, I have some thoughts:

1. In a technical sense, for a currency-issuing government (like the UK), bonds are not necessary to fund spending because the government can create money. However, bonds are still issued to manage reserves and interest rates, and their sale does absorb liquidity from the system. The phrasing "no money is raised" could be misleading. It’s more accurate to say that bond sales are not required to fund spending but are part of monetary operations.

2. You are correct that T-bills don’t carry an interest rate but are sold at a discount. But the implied yield is still an interest rate in economic terms (the discount reflects the interest). The distinction is semantic, but important for clarity.

3. Modern central banks often use a "corridor system" where the rate is set by the central bank’s lending/deposit facilities, not just reserve scarcity. The Bank of England uses a "floor system" where reserves are abundant, and the rate is set by the interest paid on reserves.

4. OMF is not standard policy. It’s a theoretical proposal, not current UK practice (unless I have missed some change in the last year.