The Logical Impossibility of Neoliberal Economists’ Tax First, Spend Later Mantra

MMT Economics: A stream-of-consciousness rumination on whether the common belief that government must tax first in order to spend later holds up to scrutiny

MMT Economics: What you will learn:

Examining the logic behind neoliberal economists’ claim that taxes must precede government spending; exposing contradictions within the tax first, spend later maxim; why foreign sector surpluses matter; why commercial banks aren’t the source of net new currency; why taxes and government borrowing can’t truly fund deficits and why all government spending is funded by new money.

Technical Terms/Jargon Used in This Article

You will find definitions of all of the technical terms/jargon used in this article in my series of MMT Economic Jargon Buster articles. Paid subscribers can also download my MMT Dictionary.

Is It True That Taxes Must Always Precede Spending?

This week’s post is a bit different from my usual: instead of a third-person description and discussion of a particular MMT-related topic, this post is a first-person stream of consciousness rumination on the orthodox approach to spending and taxation. That is, I explore the orthodox economists’ belief that taxes must be collected before government spending can commence. In the process of unpicking this central belief of neoliberal economics, I will ask if it is even logically possible to tax first and spend later while at the same time being able to maintain a ‘healthy’ economy.

The orthodox story: taxes come first

Let’s jump straight in: orthodox economists say that tax revenues fund spending; they say that finance is scarce; they say that governments must run balanced budgets – or face unsustainable debts (which will lead to higher interest rates, inflation risk, lack of investors; fiscal constraints and fiscal policy constraints). They state these beliefs on the basis that governments are no different from households or businesses: ‘you can’t spend what you haven’t earned or borrowed’. Note that in this post, I will be using the UK as my currency issuing government of choice.

Looking at this story as an MMT advocate, I will attempt to unravel the logic behind the orthodox approach. That is, the orthodox economists' belief that it is logically possible for tax revenues to be the source of government funding. Orthodox economists know, as I do, that the private sector is unable to create net new money - so I’ll try to figure out how they get over that particular hurdle; once I’ve confirmed that this is indeed a hurdle.

My first thought is this: for the private sector to be the true source of all government funding, orthodox economists must implicitly reject the idea that there is any need for net new money creation: i.e., there is never a need for net new money to be injected into the economy: because their logic implies that a combination of bank loans and earnings from exports (or other sources of income) will be enough to meet all requirements – even during ‘down’ periods of the business cycle. This has to be the case if you assert that all spending must be funded from taxes and other earned/borrowed income. It also implies that all past and present UK pounds came from somewhere other than the UK Government.

On the basis that businesses and individuals don’t create net new money - they just pass it around among themselves - I have to assume that the orthodox economists' explanation goes something like this. It is not the government that is the source of money that generates private sector growth and the subsequent creation of taxable income—rather, it is principally down to either foreign sector income, bank lending or some other income source. I’ll set aside foreign sector income for now - as neither the UK nor the US have run a trade surplus – for decades. And I will set aside the idea that there is ‘some other income source' because taxes make up by far the largest proportion of government ‘income’ - so this ‘other income’ would be of no consequence. Therefore, I have to assume the source of economic growth and taxes - from the orthodox perspecive - must be mostly related to bank lending.

It is true to say that it is commercial banks that control the money supply—via the creation of loans–so this could be what orthodox economists are thinking of. I would note that the money supply continually goes up and down as more or less loans are provided to private sector businesses and individuals. And I would note that those loans, as well as being issued, are continually being paid off.

However bank loans and the waxing and waning of the money supply isn’t something that can be relied upon to consistently support growth (and we must not forget the possibility of asset bubbles and financial instability.). MMT and post-Keynesian economists view bank lending as important but, they would assert, that that is the case only within the context of government policy and overall demand within the economy (historical data backs up this assertion). That is - it is primarily the existing level of demand within the economy and government spending/taxation policies that influence the demand for borrowing and investment. I.e., it is not so much that bank lend creates growth, it is more that growth leads to greater bank lending.

So, I’m looking at this scenario, and I can’t figure out how orthodox economists can justify their assertion that taxes must come first and spending later, when in reality it’s impossible to maintain a healthy economy while sticking to that rule. In support of my assertion, there are three main points that are rattling around my mind.

If you have any questions or if you disagree with anything I write in this article, I want to hear from you. Please add your comments in the discussion area. Contrary views are welcome.

Consider the historical fact that most governments - in order to sustain and grow their economies have needed to run deficits - most of the time.

Consider the fact that there is a proven correlation between government spending and economic growth in the UK (Crafts, Nicholas. 2018. “Post-War Economic Growth in Britain”). When the government spends more, the economy tends to grow more.

Consider the fact that that although fiscal surpluses are rare (i.e. government taking money out of the private sector), when not offset by foreign inflows, they have most often lead to economic downturns. For example: United States (Clinton’s surplus), Early 2000s (2000–2001); United Kingdom, Early 1980s (surpluses of 1988 and 1989) and Eurozone Countries Post-2010.

In other words, without a net injection of new money (either by the state or from net positive earnings from foreign sector sales) modern economies literally don’t work. When sticking to the rules, as described by orthodox economists, economies, tend towards recession. Note, as I mentioned earlier, neither the US nor UK have earned anything from exports in decades: so if a new injection of net funds is needed to maintain a healthy economy - where do they say it is coming from? It’s not commercial banks - commercial banks create no net new money.

Here’s a fly in the ointment for orthodox economists: when an injection of net new money is needed to keep the economy from falling into recession that money has always comes from the government: it is that injection of money that acts as a catalyst for growth and recovery.

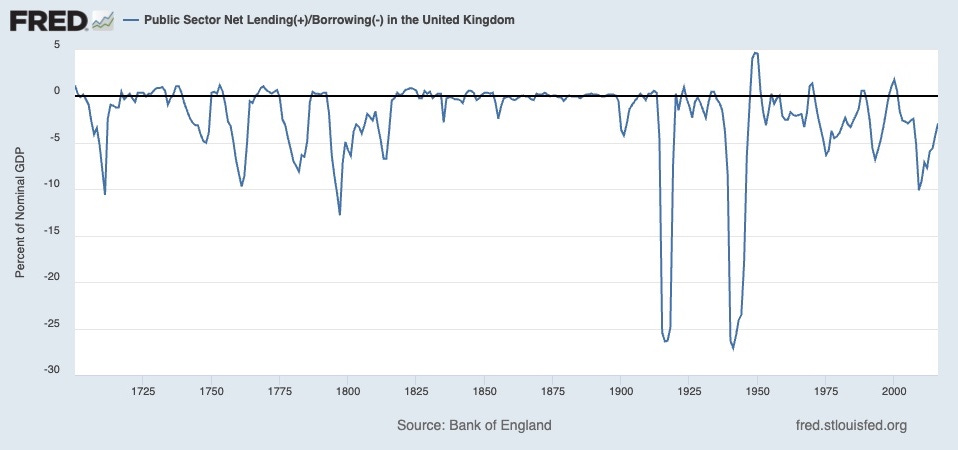

Here’s my favourite graph, which shows 300 years of mostly UK government deficits. When the blue line is below the black horizontal line - that indicates a UK government deficit. And here’s an axiom (a self-evident truth): if all government spending came only from taxes, deficits are impossible. Given that this is the case, should the orthodox view be updated to: ‘taxes fund spending sometimes but at other times they don’t, because there are times when that is logically impossible'?

And then there could be an addendum to the tax first mantra - something along the lines of: ‘because we know that the government issues the currency and historically we have taken advantage of that fact, when the logic of tax first, spend second idea has broken down.’ Because, as everyone knows, it’s logically impossible to finance a deficit with taxes: a deficit by definition is spending in excess of taxes. So, in that instance (i.e., funding a deficit) we will admit that government spending must come first. Because we can’t deny that history shows deficits are the default condition for most governments.

Unblocking the Drain of Private Sector Money

Why is it that I can say with confidence that deficit spending is required when foreign sector earnings are not positive? Well, because money is constantly being drained from the private sector: citizens and businesses save a proportion of their income; taxes get paid; loans get repaid; imports get bought; corporate earnings get retained and so on. If money is constantly being drained from the private sector (and it is) then that leaves less and less money circulating in the economy. Less and less money circulating in the economy means less and less economic activity, which means slow or no growth. Most likely it also means higher private sector debts and economic downturns.

The Logical Disconnect within the Orthodox Story

These points undermine the argument that taxes must always come first and government spending second. The above points lead me to the conclusion that the orthodox story is logically impossible.

Simply put, if governments must collect taxes before spending - and the history of deficits tells us that tax income is rarely enough to meet government spending requirements – that tells us that tax income needs to be topped up in some way. That ‘way’ cannot include ‘borrowing’ from the private sector - because government borrowing is neutral as far as government deficits are concerned (government borrowing in practice simply swaps one government liability for another and does not generate money that can be used as part of government spending). Even if borrowing from the private sector did raise money for the government - taking money out of the private sector in order to spend it back into the private sector has no effect on the government deficit. The first action cancels out the second action. (That’s not to say borrowing can’t be used as a progressive policy option, i.e. as a way to redistribute wealth by taking from the wealthy and giving to the less wealthy.)

All government spending is issued the same way

The reality is that all government spending (by currency issuing governments) is issued in the same way; there’s no special ‘deficit spending’. And there is no pile of tax income - digital or otherwise (taxes are destroyed when they are paid). In fact it’s not even possible to run a balanced budget - because governments can only estimate how much tax income will be ‘available’ at the end of the tax year; and that comes after the spending has occurred. And just as a side note, estimates of tax income used to provide a guide for how much spending can occur are seldom accurate.

Even if I could be convinced that conceptually taxes come first and spending comes later; in practice spending always comes first: and that spending is new money issued by the central bank on the authority of the government via the HM Treasury (In the US it is the Fed). These facts can’t be disputed no matter the economic school of thought you belong to.

It is this sequence, and the spending legislation surrounding it, that ensures that all UK Government spending decisions must, by law, be carried out by the central bank, that allows our economies to avoid collapse. And it is this sequence that allows MMT advocates to say with confidence that finances are, technically, not limited. MMT advocates add to that assertion by saying that it is resources to spend government currency on that are limited — not finance.

MMT reveals that the amount of money a currency issuing government spends (and what it is spent on) is a political decision and not a logical outcome of some universal law relating to taxing and spending. MMT advocates, therefore, are able to say that the job of government is not to manage financial deficits (within resource constraints) but to manage real deficits: poverty, unemployment, stilted potential of citizens, wellbeing and so on.

All Spending for Currency Issuing Governments Is New Money

In practice, it is governments that issue new currency into the economy and from that pool of money taxes are paid (all spending is issued in the same way, there’s no special ‘deficit spending’). To put it bluntly, it’s not possible to tell citizens that they must pay their taxes in your currency if you haven’t yet issued that currency.

Certainly it is valid to say that it was the imposition of taxes in the first place that allowed governments to resource themselves, i.e. employ teachers, soldiers, build the country’s infrastructure and so on. However, that is not the same as saying that it is tax revenues that are used to pay for those resources. As I’ve demonstrated - there is not pile of tax revenues to draw from: taxes are a debt citizens owe to the government; and when taxes are paid that debt is struck off.

If you are an orthodox economist reading this, now’s your chance to find the holes in my argument. Go for it.

That’s your lot for now. Don’t forget to subscriber for more MMT economics related content from MMT101/

While I have your attention, did you know I have a comprehensive MMT online training course that all paid subscribers get access to? Review the contents of the course here.

Resources

Historically the UK has ran deficits - House of Commons Library – The budget deficit: a short guide

The Untold Story Of How Clinton's Budget Destroyed The American Economy

Links to some of my most popular newsletters

Become a paid subscribers for access to additional content:

A Permanent Home for MMT101 Paid Subscriber Resources – Factsheets, book recommendations, academic papers, MMT podcasts and more.

MMT Factsheet 3: If Taxes Are Not For Spending What Are They For?

The truth, I think, is that the vast majority never really think about money. We grow up with it from childhood, we know we need it, we work to earn it, and it just seems to exist. If asked, I suspect most people would still suggest it's got something to do with gold.

There was indeed a time, centuries ago, when wealth was tied to possession of scarce commodities such as gold, and when (to adapt a phrase) there was no such thing as government money, only the king's money. If the king wanted to, say, fight a war, he needed money to buy armaments and pay soldiers, and would demand a contribution (i.e. taxes) from the wealthy aristocrats.

I'm sure that this model lies at the back of most people's minds, including orthodox economists who should know better.

It can be hard to accept that all this money we all depend on is not in the modern world based anything solid, of intrinsic value, but is merely a very large, fomalised system of IOUs. And that furthermore, the records of these IOUs are (apart from a relatively small amount of cash) nothing more than digital numbers in computer files. It all seems too ephemeral. There must be some substance, somewhere, surely?

But this IS how it works, and, because an IOU is a declaration of a loan, all money is debt. It's on loan either from a commercial bank or a central bank. Your mortgage has to be repaid, and the central bank money has to be returned as taxes. It's never "your" money.

We also talk about successful people as "making money", but of course they don't. That would be forgery or fraud. They accumulate money, they don't increase the money in circulation. If they accumulate an unfair share, they have an obligation to return a larger share through taxes. Taxation is not taking away "their" money.

Since stumbling upon MMT a decade ago, I've made a habit of making people uncomfortable at cocktail parties, family gatherings, and the occasional political meeting by asking them where they think the money they use to pay taxes comes from. Hilarity always ensues. Ultimately, no one -- and these are mostly highly educated, high net-worth individuals -- has the vaguest clue. Or if they have a clue, they can't seem to draw the obvious, indisputable conclusion about the relationship between taxation and federal spending. And when I explain it to them, they look at me like I have two heads, and continue to complain about their "taxpayer dollars" being misspent -- on whatever governmental programs they dislike -- or to insist on the need to heavily tax the ultra-rich to pay for the programs they like. (When I tell leftists, in particular, that there are lots of good reasons to heavily tax billionaires, but paying for social welfare programs isn't one of them, they look at me like I'm an Enemy Of The People.)

The indubitable truths of MMT have been available to the public in the US since at least since 1946, when Marriner Eccles published his 8 page paper "Taxes For Revenue Are Obsolete." The fact that that nearly everyone everywhere continues either to be unaware of those truths or to deny them drives me to despair every bloody day.